Master Product Market Fit Validation for Startup Success

Product-market fit validation is how you prove that a real, sizable group of people actually wants—and will pay for—what you're building. It's the critical process that separates a product people genuinely need from one that's just another statistic. Think of it less like a one-time checkbox and more like a continuous conversation with your market.

Why Most Products Fail to Find Their Market

Let’s get one hard truth out of the way: most new products don't make it. This isn't just a string of bad luck. It's usually a direct result of founders failing to confirm that a market truly wants what they've built. Without a clear validation process, teams fall into the trap of creating solutions for problems that don't exist or, more commonly, problems that aren't painful enough for anyone to bother solving.

The consequences of skipping this step are brutal. A mind-boggling 95% of new products fail every year, and around 90% of all startups ultimately shut their doors. I don't share these numbers to scare you, but to underscore just how vital early and continuous PMF validation is. You can dig deeper into these product launch stats and see how to sidestep common mistakes by exploring key findings on new product failures on Centercode.

The Real Cost of Ignoring Validation

When you ignore validation, you're not just burning cash—you're torching resources, time, and team morale. Building features no one uses is obviously expensive, but the opportunity cost is what really hurts. Every development sprint wasted on an unvalidated idea is a sprint you could have spent solving a genuine customer pain point.

Practical Example: Imagine a SaaS startup spends six months building a complex, AI-powered reporting dashboard because it sounds innovative. But they never asked their customers what they actually needed. After launch, they find out their users just wanted a simple CSV export to use in their own spreadsheets. That's six months of development and thousands of dollars down the drain on a feature nobody uses, all because they skipped a few simple validation conversations.

This is exactly why so many marketing efforts fall flat. Pouring a huge budget into ads for a product that doesn't connect with its target audience is a surefire way to fail. Often, the problem isn't the marketing campaign; it's the product's fundamental disconnect from the market. Getting this right is the first step in avoiding the pitfalls behind many failed ad campaigns.

The fundamental difference between a product people use and one that gets ignored is a relentless commitment to validation. It's about listening more than building and learning more than launching.

What This Guide Will Cover

To help you navigate this crucial journey, I've put together a practical, actionable playbook. This guide cuts through the noise and gives you clear steps to take at every stage. Before we dive into the details, here's a quick look at the core stages we'll cover.

The Core PMF Validation Stages

| Validation Stage | Primary Goal | Key Activity |

|---|---|---|

| Stage 1: Define & Measure | Establish clear, quantifiable signals of market demand. | Identify core PMF metrics like the 40% rule, NPS, and retention rates. |

| Stage 2: Gather Insights | Understand the "why" behind user behavior. | Design and deploy targeted surveys and conduct user interviews. |

| Stage 3: Test Hypotheses | Validate your assumptions with real-world feedback. | Leverage communities like Reddit to test messaging and find your tribe. |

| Stage 4: Build Feedback Loops | Make validation a continuous, integrated process. | Create systems to consistently collect, analyze, and act on user feedback. |

Throughout this guide, you’ll learn how to move from a rough concept to an indispensable solution by focusing on these key areas. It's all about making validation a core part of your product's DNA.

The Real Numbers That Show You've Found Product-Market Fit

Gut feelings might get you started, but they won't build a sustainable business. To know if you're really onto something, you have to look at the cold, hard data—the quantitative signals that show what your users actually do, not just what you hope they'll do.

This is where we move beyond theory. Forget vanity metrics like website traffic or total sign-ups. We're digging into the numbers that tell the real story: user sentiment, how long they stick around, and how often they come back. These are the vital signs of your product.

The 40% "Can't Live Without It" Test

One of the most effective ways to gauge product-market fit comes from a single, powerful survey question. Sean Ellis, who helped grow companies like Dropbox and Eventbrite, came up with this. He found that if at least 40% of your users say they would be "very disappointed" if they could no longer use your product, you're likely on to something big.

This isn't just a random number; it's a benchmark for indispensability.

Actionable Insight: Don't send this survey to everyone. Target users who have experienced the core value of your product—for example, those who have been active for at least two weeks or have used a key feature more than three times. This ensures you're polling informed users, not just casual browsers.

A Simple Survey Script You Can Steal

Question 1: "How would you feel if you could no longer use [Your Product Name]?"

- A) Very disappointed

- B) Somewhat disappointed

- C) Not disappointed

Follow-Up (if they chose "Very disappointed"): "What's the main benefit you get from [Your Product Name]?"

Follow-Up (if they chose B or C): "What would you use as an alternative if [Your Product Name] wasn't available?"

The follow-ups are gold. They reveal exactly why your super-users love you and, just as importantly, who your real competition is in the eyes of everyone else.

Beyond Surveys: Watching What Users Actually Do

The 40% rule tells you what users say. But the ground truth lies in what they do. This is where retention and product stickiness become your best friends.

User Retention is your single most important metric. It's the percentage of users who keep coming back over time. If you have a leaky bucket—tons of new sign-ups but nobody sticks around—you don't have product-market fit. It’s that simple.

What's a "good" retention rate? It really depends on your industry.

- For B2B SaaS: You should be aiming for 90-95% monthly retention. These tools get baked into a company's daily workflow, so they tend to be stickier. A project management tool like Asana is a good example; once a team is onboarded, it's very hard to switch away.

- For Consumer Apps: The bar is a bit lower. A monthly retention rate of 40-60% is often considered strong, since you're competing for fleeting attention. Think of a meditation app like Calm; even if users love it, they might only use it a few times a week.

A high retention rate is the ultimate proof that your product delivers real, recurring value. It’s the market giving you a vote of confidence, month after month.

Another fantastic metric is the DAU/MAU Ratio—your Daily Active Users divided by your Monthly Active Users. This little number tells you how "sticky" your product is by showing how many of your monthly users engage on a daily basis.

A high ratio means you've built a habit. Facebook, the king of stickiness, has a DAU/MAU ratio well over 50%. For a B2B tool, hitting 20-30% can be a massive signal that you've become an indispensable part of your users' workday. For example, if you have 1,000 monthly active users and 300 of them log in every day, your DAU/MAU is 30%—a strong indicator of stickiness.

Are Your Users Your Sales Team? The Net Promoter Score

Finally, there's the Net Promoter Score (NPS). This helps you figure out if you have true fans who will spread the word for you. It all comes from one question: "On a scale of 0-10, how likely are you to recommend [Your Product Name] to a friend or colleague?"

Your score is calculated by subtracting the percentage of Detractors (scores 0-6) from the percentage of Promoters (scores 9-10). Any positive score is a start, but a score over 50 is generally considered excellent.

Actionable Insight: Don't just look at your overall NPS score. Segment it by user type. For instance, what's the NPS for users on your free plan versus your paid plan? Or for new users versus users who have been around for six months? If your paid users have a much higher NPS, it's a strong signal that your core value proposition is worth paying for. To really nail down the practical side of this, it's worth reading up on how to measure Product Market Fit from multiple sources.

To get started, tools like Mixpanel or Amplitude are great for tracking behavior, while Typeform or Hotjar make gathering sentiment data like the 40% rule and NPS incredibly easy. For a complete guide on how all these pieces fit together, check out our deep dive on the product market fit framework.

Gathering Qualitative Insights That Drive Product Decisions

Metrics tell you what is happening. They show you the churn rate, the conversion funnels, and the engagement stats. But they almost never explain why.

A high churn rate is a signal, but it's not the story. It doesn't tell you about the core frustration that finally made a user give up. This is where you have to go beyond the spreadsheet and talk to actual human beings. Qualitative insight is your secret weapon for finding product-market fit.

Meaningful conversations are the only way to uncover the context behind the numbers. You get to hear about their workflows, their anxieties, and the real-world messes they're trying to clean up. Without that human context, you’re just guessing.

Mastering the Art of the Customer Interview

The goal of a customer interview isn't to fish for compliments. Asking leading questions like, "Don't you just love our new feature?" is a waste of everyone's time. Your real job is to get them to tell you a story.

Actionable Insight: To get people to talk, offer a small incentive like a $25 gift card. Target two groups for interviews: your power users (to find out what they love) and users who recently churned (to find out what went wrong). The insights from the churned group are often the most brutally honest and valuable.

Open-Ended Questions That Unlock Real Insights

Instead of asking about features, ask about their life. Here are a few prompts I've found to be incredibly effective:

- "Tell me about the workflow you used before you found our product. What were the most frustrating parts?" (This uncovers the core pain point you're solving).

- "Walk me through the last time you used our product. What were you trying to accomplish?" (This reveals usability issues and unexpected use cases).

- "If you had a magic wand and could change one thing about how you solve [the core problem], what would it be?" (This helps you see beyond your current solution).

- "What's the biggest thing that almost stopped you from signing up or paying for our product?" (This identifies friction in your onboarding and sales process).

These questions aren't just asking for opinions; they're asking for experiences. This approach is how you uncover the true "job-to-be-done"—the fundamental progress a customer is trying to make in their life. Someone isn't just "buying project management software"; they are "hiring" it to reduce the stress of missed deadlines and bring a sense of calm to their team. Understanding that "job" is everything.

Qualitative feedback is the bridge between a user's behavior and their intent. Data shows you the path they took; conversations tell you why they chose that path in the first place.

Uncovering Unfiltered Truths on Reddit

Direct interviews are invaluable, but some of the most honest feedback comes from places where people feel safe to speak their minds. For that, Reddit is a goldmine.

It's packed with unfiltered, candid conversations about virtually any problem space you can imagine. The beauty of it is that you can just listen. You get to see how your target audience talks about their challenges when they think no marketers are watching. Pay close attention to the exact language, slang, and acronyms they use—it’s priceless for shaping your product and marketing copy.

Finding Your Audience in the Right Subreddits

First, you need to find the digital watering holes where your potential customers hang out. Don't just search for subreddits about your product category; look for communities built around the problem you solve or the identity of your user.

Let's say you built a time-tracking app for freelance developers. Your research might lead you to these communities:

- /r/freelance: A broad community discussing client management, pricing, and productivity.

- /r/webdev: A technical subreddit where developers discuss tools and workflows.

- /r/digitalnomad: A community focused on the lifestyle of remote work, where productivity tools are a constant topic.

Actionable Insight: Once you’ve found these places, use Reddit's search function within each subreddit to look for keywords related to your problem space, like "tracking hours," "client billing," or "time management sucks." The posts that generate a ton of discussion are where the gold is. Note the top-voted comments—they often represent the most widely held opinions or frustrations within that community.

What to Look For in Reddit Discussions

As you read through the threads, keep an eye out for a few key things:

- Pain Point Language: How do they describe their frustrations? Note the exact phrasing they use. If people constantly complain about "scope creep" from clients, that's a phrase you should be using on your landing page.

- DIY Solutions: What workarounds or "hacks" are people using? If they're stitching together Google Sheets, a timer app, and a separate invoicing tool, that's a massive opportunity for your all-in-one solution.

- Competitor Mentions: When your competitors are mentioned, what do people praise and what do they complain about? This is free, unsolicited competitive intelligence.

By analyzing these raw conversations, you gain a deep, empathetic understanding of your market's needs. This qualitative research doesn't replace your metrics, but it gives them meaning. It provides the critical "why" that drives smart product decisions and puts you on the fast track to validation.

So, you’ve found product-market fit. Congratulations. Now the real work begins.

Product-market fit isn't a one-and-done achievement you can frame on the wall. It’s a moving target. Markets change, your customers’ needs evolve, and new competitors are always just around the corner. If you're not constantly listening and adapting, that perfect fit you worked so hard to find can vanish.

That's why you need to build a system for continuous validation right into your company's DNA. This isn't about creating a giant backlog of feature requests. It's about developing a structured, repeatable process for turning raw user feedback into smart product improvements that keep you ahead of the curve.

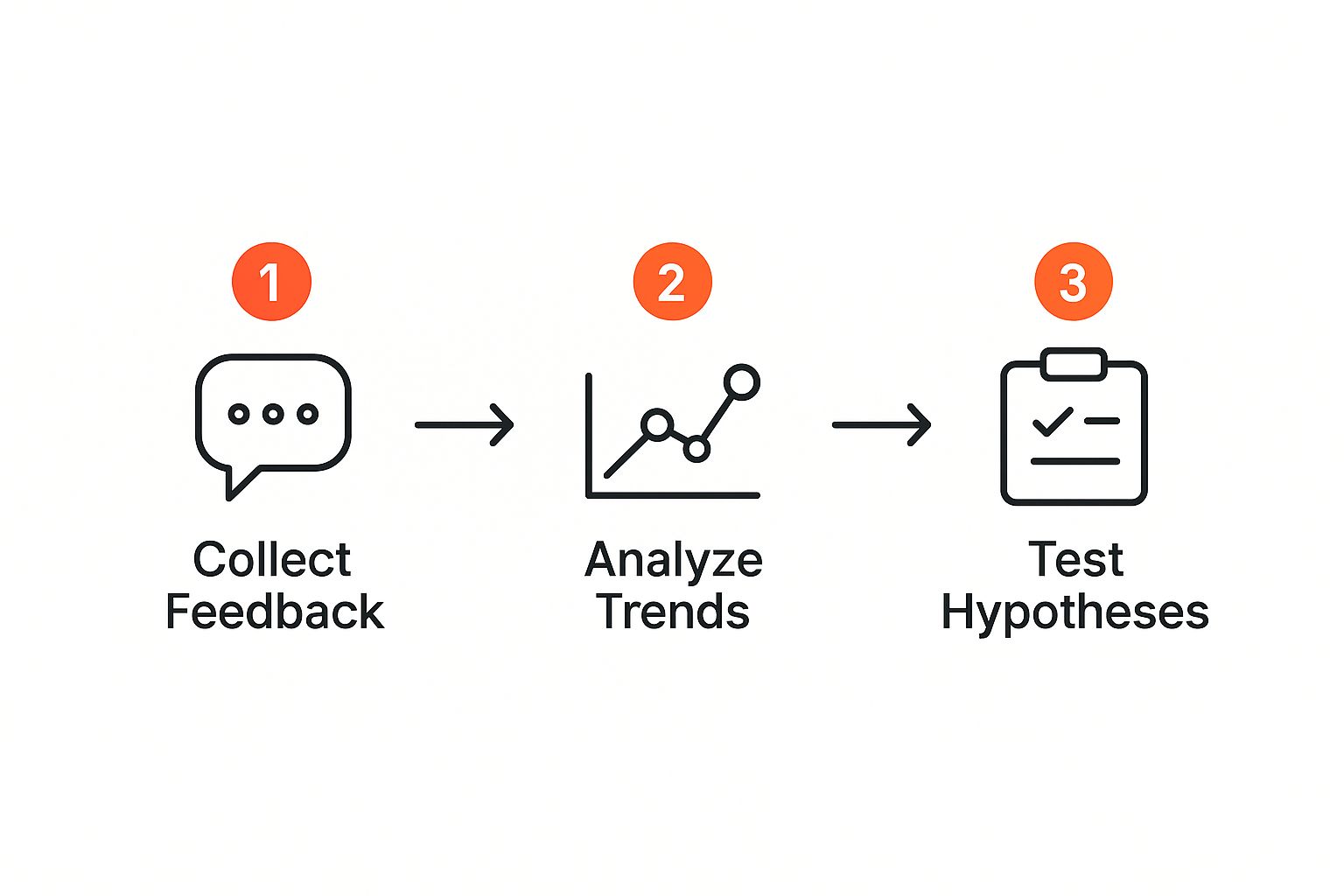

This simple framework breaks the process down into three core actions that feed into each other, creating a powerful loop.

As the visual makes clear, this is a cycle. You collect feedback, hunt for patterns, and test your ideas. Then you do it all over again.

Make it Effortless to Collect User Feedback

First things first, you have to create channels for feedback to flow to you. The trick is to make it incredibly easy for users to share their thoughts without getting in their way. Nobody likes aggressive pop-ups or long, mandatory surveys.

Instead, go for low-friction methods that capture insights at just the right moment.

- In-app feedback widgets: Tools like Hotjar or Canny are great for this. A simple "Got feedback?" button tucked away in the footer or user menu is all it takes.

- Post-interaction surveys: After a user completes a key action, hit them with a quick, one-question survey. For instance, once a support ticket is resolved, you could ask, “How satisfied were you with the resolution?” or after a user exports a report, you could ask, "Did this report give you the data you needed?"

These automated touchpoints ensure you’re constantly gathering feedback from your most active users—the ones who are often the most insightful (or the most frustrated).

Find the Patterns in the Noise

Raw feedback is just noise. A torrent of comments, emails, and survey responses is useless until you organize it. This is where you put on your detective hat and start looking for the real story hidden in the data.

I’ve found that using a dedicated tool like Productboard or Dovetail is a game-changer. As feedback rolls in from all your channels (widgets, support tickets, sales calls), you can funnel it into one central place.

Your goal here is to find the signal. Don't just count up feature requests. Look for the underlying problem that different users are describing in their own words.

Practical Example: You might see 10 users asking for a "dark mode," 5 asking for "custom themes," and 8 asking for a "compact view." The amateur move is to create three separate feature requests. The pro move is to tag them all under a broader theme like "UI Personalization." This shows you there's a significant user need for controlling the app's appearance, which is a much more strategic insight than just a list of features.

Turn Insights into Testable Ideas

Once you've zeroed in on a recurring pain point, it's time to form a hypothesis. This step is critical because it turns a vague user problem into a specific, testable solution, preventing you from wasting months building something nobody actually wants.

Let’s stick with our UI personalization example. A weak approach would be to just start building a full theme engine. A much stronger, testable hypothesis would be:

Hypothesis: "We believe that by offering a simple 'Dark Mode' option, we can reduce eye strain for our power users who work late at night. We predict that users who enable Dark Mode will have 15% longer session durations during evening hours (after 6 PM)."

See the difference? This statement is specific, measurable, and tied directly to a business goal. It clearly defines the who (power users), the what (reduced eye strain), and the why (longer sessions).

From here, you can run a small, low-risk experiment. Don't build the whole thing yet! Start by shipping just the dark mode toggle to a beta group. Measure the results against your hypothesis. This approach lets you validate the idea's value before you sink a ton of development resources into it, keeping your roadmap grounded in what users actually need.

Learning from Real World Validation Journeys

Theory is great, but the real lessons in finding product-market fit are learned in the trenches. Looking at how now-iconic companies navigated their own make-or-break moments shows these abstract principles in action.

These stories prove that finding PMF is almost never a single "aha!" moment. It's a messy, iterative process of listening, learning, and making bold bets based on what real people are telling you. Let's break down a few of these journeys to see how they put these ideas to the test.

Airbnb: The Power of High-Fidelity Feedback

In its early days, Airbnb was barely surviving. The founders, Brian Chesky and Joe Gebbia, saw a troubling pattern in their data: listings in New York City had painfully low booking rates. The numbers screamed that there was a problem, but they didn't explain why.

Instead of just tweaking their algorithm or throwing money at ads, they did something that famously doesn't scale. They flew to New York, booked their own listings, and met with their hosts.

What they discovered had nothing to do with code—it was the photos. Hosts were using grainy, poorly lit pictures from their phones, which made the listings look unappealing and untrustworthy.

Their hypothesis became incredibly simple: better photos would lead to more bookings. To test it, they rented a high-quality camera and went door-to-door, taking beautiful pictures of their hosts' apartments themselves. The impact was immediate. Listings with professional photos saw two to three times more bookings, and the company's New York City revenue doubled in a single week.

This wasn't a minor tweak; it was a profound realization that the presentation of the product was just as crucial as the underlying service. As many successful companies have shown, listening to your customers is the key to growth. You can discover more insights about PMF's importance on VIVA TECHNOLOGY.

The Takeaway: Sometimes the most important validation signal isn't in a spreadsheet. You find it by directly observing your users' experience and identifying the friction they don't even know how to tell you about.

Slack: Validating an Internal Tool for the World

Slack’s origin is a classic case of finding product-market fit for something that was never even meant to be a product. The communication tool we know today was originally built by a gaming company, Tiny Speck, just to help its own team collaborate while building a game called Glitch.

The game ultimately failed. But the team realized the internal tool they’d built was incredibly valuable. They had accidentally solved a universal pain point for modern teams: messy, inefficient communication scattered across email, chat apps, and file-sharing services.

Their validation process was unique because they were their own first customers. They had spent years perfecting the tool to solve their own daily frustrations. When it was time to pivot, their product-market fit validation was less about finding a market and more about confirming that other companies felt the same pain.

They started by sharing it with friends at other tech companies. The enthusiastic, "can't-live-without-it" response from these early users was the signal they needed to go all-in. This kind of journey from side-project to success is a hot topic in communities like the r/indiehackers subreddit.

Superhuman: Manufacturing Demand Through Rigorous Filtering

Superhuman, the email client built for power users, took a quantitative and almost ruthless approach to validation. Founder Rahul Vohra became obsessed with the Sean Ellis "40% Rule," which we covered earlier. He systematically surveyed every new user with that one critical question: "How would you feel if you could no longer use Superhuman?"

But he didn't just measure the results—he weaponized them. The survey became the filter for his entire onboarding process and product roadmap.

Here’s his validation engine worked:

- Segment Users: He split respondents into three buckets: the "very disappointed" (his fans), "somewhat disappointed" (the on-the-fencers), and "not disappointed" (the detractors).

- Focus on the Fans: He doubled down on what this core group loved, using their feedback to sharpen Superhuman's value proposition. For example, he found they loved the speed and keyboard shortcuts, so he made those the core of his marketing message.

- Learn from the On-the-Fencers: He obsessively analyzed feedback from this middle group to figure out what was holding them back. If they said, "I'd love it if it had a calendar integration," that feature went straight to the top of the roadmap.

By focusing relentlessly on converting "somewhat disappointed" users into die-hard fans, Superhuman systematically engineered a product that created intense word-of-mouth and a legendary waitlist. They didn't try to be for everyone; they validated their fit with a specific niche and then built an engine to expand from that fanatical core.

Common Questions About Validating Product-Market Fit

As you dive into validating your product, you're bound to hit some roadblocks and have questions. It's a messy process, and frankly, what works for one startup might completely flop for another. Let's tackle some of the most common questions that come up.

How Long Does It Take to Find Product-Market Fit?

I wish I could give you a magic number, but there isn't one. The honest answer is: it depends.

Some founders get lucky and see strong signals in just three to six months, usually because they've targeted a very specific, painful problem. For most of us, though, it's a much longer grind. It can take years of tweaking, iterating, and sometimes a full-blown pivot before you finally feel things "click."

The real secret is to stop thinking of it as a finish line. It's not a one-and-done task you check off a list. Markets shift, competitors pop up, and customer expectations are always changing. Once you find that initial fit, you have to keep listening and validating to hold onto it.

What's the Difference Between Problem-Solution Fit and Product-Market Fit?

It helps to think of these as two separate, crucial milestones on your journey.

Problem-Solution Fit: This is your starting point. It’s all about confirming that you've identified a real, painful problem and that your idea for a solution actually makes sense to a small group of early adopters. Practical Example: You interview 20 freelance designers and learn that creating client proposals is their most hated task. You show them a simple Figma mockup of a tool that automates this, and they get excited. That's problem-solution fit.

Product-Market Fit: This is the big one. It's the proof that you've successfully turned that idea into a real product that a much larger market not only wants but is willing to pay for and integrate into their lives. This is where you lean on hard numbers: high retention rates, organic growth, and solid scores on the Sean Ellis test. Practical Example: You've built the proposal tool. Now, 500 designers are paying for it, your monthly churn is below 5%, and over 40% say they'd be "very disappointed" if they couldn't use it anymore. That's product-market fit.

Problem-solution fit means you've got a great idea. Product-market fit means you've got a real business. You can't have one without the other.

Can I Validate PMF with Only a Few Users?

Yes, and in the early days, you absolutely should. A dozen deep, insightful conversations with people who perfectly match your ideal customer profile will give you far more actionable feedback than a generic survey blasted out to 1,000 random people. At this stage, you're hunting for depth, not breadth.

However, when you shift to quantitative validation—like the Sean Ellis "40% rule" survey—you need a more robust sample size for the data to mean anything. A good rule of thumb is to aim for at least 50-100 responses from your active user base.

Actionable Insight: Don't let a lack of users stop you. If you only have 10 active users, interview every single one of them. Their qualitative feedback is your most valuable asset for getting the next 100 users. Prioritize the quality of your feedback over the sheer quantity. A single, passionate user who truly gets what you're doing is worth more than a hundred who are just kicking the tires. To get a better handle on this foundational concept, it’s worth digging into what product market fit truly means for a startup.

Ready to get real, unfiltered feedback from your target audience? Reddit Agency helps you tap into niche communities to validate your ideas, gather insights, and build a base of loyal first users. Learn how we can accelerate your product-market fit validation on Reddit.